What is MagicFormula?

Welcome to MagicFormula Review: The Magic Formula is an investment strategy outlined by Joel Greenblatt in his 2005 book The Little Book That Beats the Market. Its purpose is to aid investors in finding high-quality stocks at a reasonable price.

The formula is a very simple one, which just has two key variables – Earnings Yield and Return on Capital. An earnings yield considers a stock as cheap or expensive by its true business earnings, while a return on capital tells how effectively a company is making use of its money into profits.

This makes it even more interesting playing only longs and long/short strategies among all the stock at a syga and above market cap rankings. This then consolidates all the stocks and ranks them as one list again.

Get MagiFormula Instant Access

How does it work?

Setting the Universe of Stocks:

- The formula is applied to stocks with a minimum market capitalization, often set at $50 million to exclude very small companies that might be too volatile or illiquid.

- Stocks are also filtered to exclude utility and financial companies because their earnings and capital structure are different from those of industrial and other companies.

Ranking by Earnings Yield:

- Earnings Yield is calculated using EBIT (Earnings Before Interest and Taxes) divided by the enterprise value (market capitalization plus net debt). This measure is used to determine how cheap a stock is relative to the earnings it generates.

- Stocks are ranked from highest to lowest based on their earnings yield. The higher the earnings yield, the cheaper the stock is considered relative to its earnings.

Ranking by Return on Capital:

- Return on Capital (ROC) is calculated using EBIT divided by the sum of net fixed assets and working capital. This measure evaluates how effectively a company uses its capital to generate profits.

- Similar to earnings yield, stocks are ranked from highest to lowest based on their ROC. A higher ROC indicates a more efficient and potentially more profitable company.

Combining the Rankings:

- After ranking all stocks separately by earnings yield and return on capital, their rankings are combined. This is typically done by adding the two ranks for each stock. For instance, if a stock ranks 10th by earnings yield and 20th by return on capital, its combined score would be 30.

- The stocks are then sorted again based on their combined scores, with a lower score indicating a better overall ranking.

Purchasing Stocks:

- Typically, an investor following the Magic Formula would buy the top 20 to 30 stocks based on the combined rankings.

- The strategy recommends holding these stocks for a fixed period, usually one year, regardless of their market performance during this period.

Rebalancing the Portfolio:

- After one year, the investor sells the stocks (regardless of gain or loss) and repeats the entire process to select a new set of stocks based on the latest data.

- This systematic rebalancing helps to ensure that the portfolio remains focused on high-quality, undervalued stocks, aligning with the strategy’s criteria.

Best For

- Consultants

- Marketing Agencies

- Small Businesses

Alternative

- Airtable

- Google Sheets

Get Instant Access

MagicFormula Key Features:

Simplicity: The Magic Formula is designed to be simple and accessible. It uses only two financial metrics—earnings yield and return on capital—to evaluate stocks, making it easy for investors to implement without needing extensive financial knowledge or access to sophisticated financial tools.

Focus on Value and Quality: The formula combines value investing (buying stocks at a low price relative to their true business earnings) with quality investing (investing in companies that efficiently generate high returns on capital). This dual focus aims to identify companies that are both undervalued by the market and have strong business fundamentals.

Quantitative Approach: It’s a purely quantitative method that eliminates emotional decision-making by relying on specific, objective criteria to select stocks. This systematic approach helps maintain discipline in the investment process, avoiding biases that might affect stock selection.

Automated Ranking System: The strategy involves ranking all eligible stocks based on their earnings yield and return on capital, then combining these rankings to determine which stocks to buy. This ranking system helps in consistently applying the investment criteria across all potential investments.

Defined Holding Period: The Magic Formula recommends holding selected stocks for exactly one year. This fixed period helps to standardize the investment process and can potentially reduce transaction costs associated with frequent trading.

Regular Rebalancing: After one year, the strategy calls for selling the current holdings and reinvesting in a new set of stocks based on the latest rankings. This annual rebalancing ensures that the portfolio adapts to changes in stock prices and company performance, aiming to continually optimize for the best value and return on capital.

Broad Applicability: While the original guidelines suggest a minimum market capitalization (often around $50 million), the formula can be applied across various market caps and geographies, making it versatile for different investment environments.

Empirical Backing: Joel Greenblatt provided empirical evidence in his book to demonstrate the effectiveness of the Magic Formula over long periods, which has contributed to its popularity among individual investors.

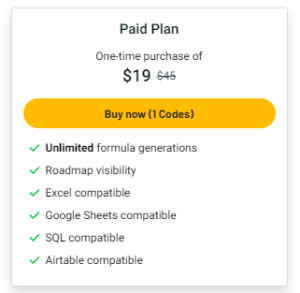

Appsumo Lifetime Plans & Features

- Lifetime access to MagicFormula

- You must redeem your code(s) within 60 days of purchase

- All future Paid Plan updates

- Access to all future AI models

- Please note: This deal is not stackable

<<<<<More Information About It>>>>>

Conclusion

The Magic Formula is a straightforward evidence-based investment strategy which finds cheap, high quality stocks using two criteria: earnings yield and return on capital. If your looking for a simple no frills, effective simple solution that ensures that you annualy rebalance your portfolio to more consistently capture market inefficiencies, it can be rather appealing to individual investors seeking a disciplined approach to stock investing.

Discover Appsumo More Deal,visit